Carbon Capture Now a Jobs Lifeline Thanks to 45Q Credit

- Sep 30, 2022

- Carbon Capture

- By admin

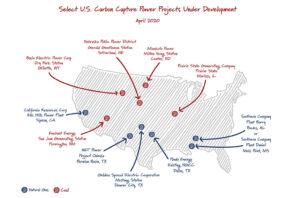

Wrongly perceived as unachievable, capture carbon is on the cusp of major development. A natural gas power plant in California. A coal power plant in North Dakota. A cement facility in Colorado. A new Louisiana LNG terminal. A Texas facility that sucks up carbon dioxide straight from the air. Dozens of new carbon capture project proposals are sprouting up across the country.

What changed to go from considering carbon capture technology a red herring, to this amazing influx of activity? In 2018, Congress updated a tax incentive for carbon capture so that if you can wrangle carbon dioxide emissions out of the air, the federal government rewards you. The policy is working as intended, helping bridge the valley of death and driving new exciting innovations in the power sector and heavy industry.

Congress passed this incentive known as “45Q”, and the White House rapidly signed into law. But, the IRS has still not issued rules on how businesses can claim the credit. More than two years into the six years given by Congress, the credit is set to expire at the end of 2023. While this deadline may seem far off, carbon capture projects take a long time to develop. Federal permits to store carbon dioxide underground alone can take over four years. Companies rightly want financial certainty before the break ground on a new project.

In a tremendous show of bipartisanship, leaders from both parties have pushed the IRS to publish final rules for how developers can claim the credit. Both Republicans and Democrats are proposing to extend the credit and give developers more time. These policies have strong tailwinds from a vast coalition of energy companies, labor unions, environmental organizations, Democrats, and Republicans. Most recently, Congressional Republicans under the leadership of Leader Kevin McCarthy introduced a long-term 45Q tax credit. At the end of the day, there is growing consensus that we can reduce carbon emissions and maintain a healthy economy. The 45Q tax incentive for carbon capture happens to be one of the most tangible solutions to achieving both.

You may be surprised how broadly this credit goes. The expanded credit promises to support clean investment across many subsectors including:

Fossil power plants. Allow existing power plants that burn coal or natural gas to be upgraded and cleaner while still generating power. New power cycles that capture carbon dioxide as a byproduct of running are also in the works.